Home Buying Checklist: What to Look For

Buying a home is a major life decision that requires careful consideration and planning. Use this comprehensive checklist to ensure that you find the perfect home that meets your needs and preferences.

1. Location and Neighborhood

Evaluate the location and surrounding neighborhood. Consider factors such as proximity to schools, workplaces, shopping centers, public transportation, and recreational amenities. Research local crime rates, property values, and future development plans.

2. Property Condition and Structural Integrity

Inspect the property thoroughly, paying attention to its overall condition and structural integrity. Look for signs of water damage, mold, foundation issues, or structural deficiencies. Consider hiring a professional home inspector to conduct a detailed assessment.

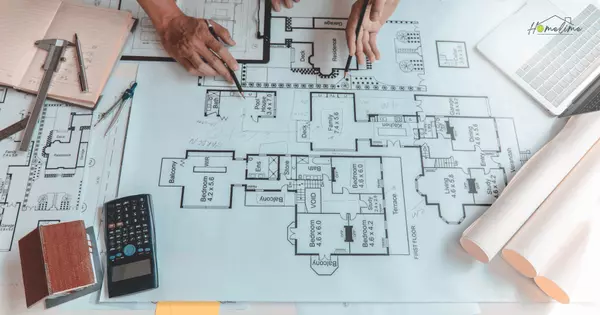

3. Layout and Floor Plan

Assess the layout and floor plan to ensure it aligns with your lifestyle and future needs. Determine the number of bedrooms, bathrooms, and living spaces. Consider the flow of the home and whether it accommodates your furniture and daily activities.

4. Property Size and Landscaping

Evaluate the size of the property and its landscaping features. Determine if there is adequate outdoor space for your needs, such as a garden, patio, or outdoor entertainment area. Consider future landscaping projects or renovations.

5. Kitchen and Appliances

The kitchen is often the heart of the home. Assess the kitchen's layout, storage capacity, and appliance quality. Consider the condition of appliances such as the refrigerator, stove, dishwasher, and microwave.

6. Bathroom Features and Condition

Inspect the bathrooms for cleanliness, functionality, and condition. Check for leaks, water pressure issues, and the condition of fixtures such as sinks, toilets, and showers.

7. Energy Efficiency and Utility Costs

Consider the home's energy efficiency and potential utility costs. Inquire about insulation, windows, HVAC systems, and energy-saving features such as solar panels or smart thermostats.

8. Homeowners Association (HOA) Rules and Fees

If the property is part of a homeowners association (HOA), review the rules, regulations, and associated fees. Understand any restrictions on property use, exterior modifications, and community amenities.

9. Resale Value and Market Trends

Even if you don't plan to sell immediately, consider the property's resale potential. Research local market trends, property appreciation rates, and buyer preferences. Choose a home that is likely to hold its value over time.

10. Budget and Affordability

Set a realistic budget that accounts for the purchase price, closing costs, property taxes, insurance, and ongoing maintenance expenses. Get pre-approved for a mortgage to determine your purchasing power and avoid overextending financially.

By utilizing this comprehensive home buying checklist, you can approach the process with confidence and make informed decisions. Remember to prioritize your needs, conduct thorough inspections, and seek guidance from real estate professionals.

Recent Posts

GET MORE INFORMATION